Atlantic City Economic Update

Several national indicators suggest that the regional economy will see a strong 2021 summer shore season. If such a season develops, it would be welcome news as the COVID 2020 recession proved especially hard on Atlantic City’s economy.

By Oliver Cooke, Ph.D., Associate Professor of Economics

National Indicators Point to Strong 2021 Summer Shore Season

Despite an April jobs report that proved weaker than expected, a host of recent indicators suggest that the national economy is poised to rebound strongly from last year’s COVID-induced recession. While April’s job gain (+266K) was smaller than those recorded in February (+536K) and March (+770), it remains true that the national economy has added jobs in 11 of the past 12 months. Reflecting this, applications for initial unemployment claims—which ballooned during the initial months of the COVID lockdown and remained elevated through much of 2020—have continued to trend down over the past several months. Retail sales remained buoyant last month as consumers—aided by fiscal stimulus—maintained their robust March level of spending (which was up +10.7% from February). Consumer confidence in April, meanwhile, was its highest in 14 months. In addition to fiscal stimulus, much of the positive momentum on the consumer front reflects a significant build-up of personal savings since the pandemic’s onset as household spending on services (e.g., vacations and dining out) slowed dramatically last year. The national savings rate rocketed to 20% in January.

Oliver Cooke, Ph.D.,

Associate Professor of Economics, Stockton University

The COVID-19 2020 Recession’s Impact on Atlantic City’s Economy

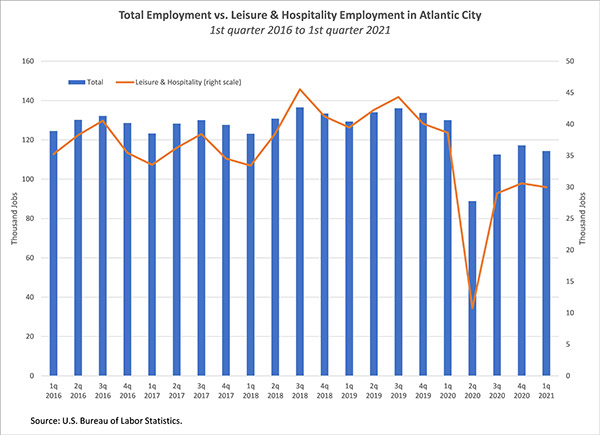

The COVID-19 recession of 2020 proved especially hard on Atlantic City’s economy, which, despite its continued diversification over the past decade, remains firmly attached to the health of its leisure and hospitality sector. For the year, total employment in the metropolitan area was down 21,000 (-15.8%).

Reflecting the 16-week shutdown of the gaming industry last year, employment losses in the leisure and hospitality sector (-14,300 or 34.4%) accounted for 68% of all jobs lost in the metropolitan area last year. A comparison to the Great Recession of 2009—when total employment declined 5.8% and leisure and hospitality employment fell 7%—underscores the severity of last year’s COVID-19 recession on the local economy and the significant hole it faces over the remainder of the year.

Recent CDC public health announcements regarding masking (which will likely increase many vaccinated vacationers’ and consumers’ overall comfort levels), the state’s recently announced reopening plans (which will ease many COVID restrictions on businesses), and the aforementioned national indicators, all suggest that the coming summer shore season should be a strong one for Atlantic City’s economy.

But, it remains true that the pace of hiring in this year’s first-quarter remained lackluster. Through this year’s first quarter, overall employment in Atlantic City remained down 12% year-on-year. The comparable figure in the metropolitan area’s key leisure and hospitality sector was -22%. A critical question is whether this first-quarter trend reflected continued hesitancy on the part of employers to hire or labor supply issues. Parsing this question out is difficult for several reasons.

On one hand, history suggests that most summer hiring occurs in April and May and employment data for April won’t be released by the U.S. Bureau of Labor Statistics until late May. On the other hand, there is anecdotal evidence both locally and at the national level that suggest that employers are having difficultly finding employees. While this has generated intense national debate over the potential discouragement effects associated with enhanced unemployment benefits that Congress extended through September, it remains true that some would-be employees (especially those in service-based face-to-face positions) may still have genuine concerns regarding safety, while others continue to face significant childcare constraints. Either of these two situations would explain recent labor force trends in Atlantic City: through the first quarter of this year, Atlantic City’s labor force was down 3.4% year-on-year (-4,100).

A further complicating factor regards the U.S. State Department’s non-immigrant J1 visa program—whose Summer Work Travel program brings roughly 5,000 international college students to New Jersey each summer—which was only recently re-opened after being shut down by the Trump administration in June 2020. Finally, unlike Atlantic City, the Cape May metropolitan area recorded robust first-quarter year-on-year job growth (+12%). While the Cape May economy’s small size often yields statistical anomalies that are subsequently smoothed out via future BLS revisions, the divergence between early 2021 hiring trends in Atlantic City and Cape May is noteworthy and warrants scrutiny over the coming months.