Tourism and Cultural Improvement Districts (TCIDs), the Next Chapter in the Maturation of New Jersey’s Tourism Industry

By: Adam Perle (President, New Jersey Travel Industry Association), Lori Pepenella (President-Elect, New Jersey Travel Industry Association), Ben Rose (Vice President, New Jersey Travel Industry Association), and Brian J. Tyrrell, Ph.D. (Professor of Hospitality, Tourism and Event Management, Stockton University)

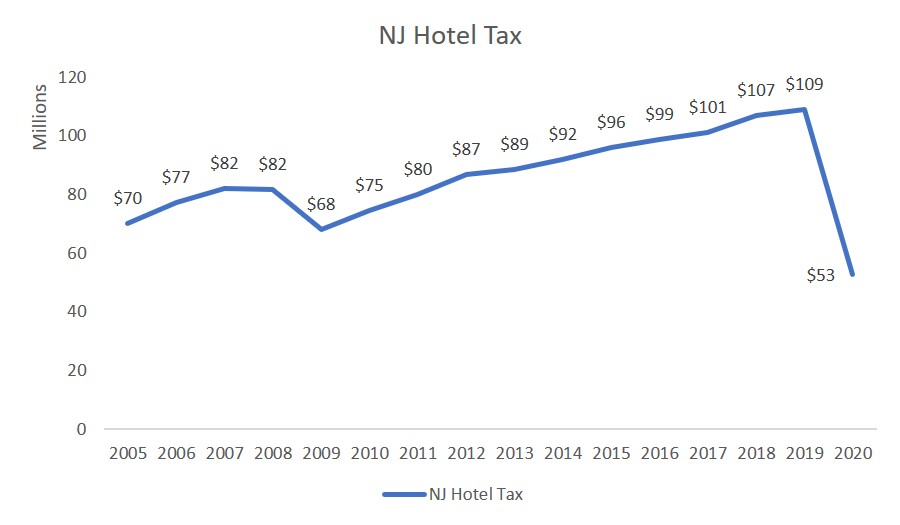

The maturation of the tourism industry in New Jersey has been significant over the past two decades. The establishment of the Hotel/Motel Tax and Fee (N.J. Hotel Tax) in 2004 provided a stable source of funding, though arguably insufficient. A review of 2012 state tourism office budgets ranked New Jersey as 32nd (U.S. Travel Association, 2013), a rank not in keeping with the revenue generated by tourism in the state of New Jersey. Funding for tourism, through the New Jersey Division of Travel and Tourism, remained largely flat since that study, though the latest budget had a small increase. The N.J. Hotel Tax has grown by over 50 percent since its first full year in 2005 to the pre-pandemic year of 2019, rising from $70 million to $109 million. This tax is crucial to tourism in the state as it helps to fund the New Jersey Division of Travel and Tourism’s promotional efforts, as well as the New Jersey Destination Management Organization (NJDMO) grants and the Cooperative Marketing grants. The NJDMO grant is a program that has seen NJDMOs solidify a strong tourism management infrastructure throughout the state. The strong DMOs that now dot the state are aided by this grant, the structure of which recognizes the unique regions, tourism infrastructure, culture, and the flow of visitors to our state.

In fiscal year 2019 and 2020, over $1.8 million was distributed to fourteen regional DMOs through the NJDMO grants, in awards ranging from $108,000 to $150,000 (New Jersey Division of Travel and Tourism, 2020). The budget of the New Jersey Division of Travel and Tourism totaled $9 million each of these years. That figure includes the $1.8 million and an additional Cooperative Marketing Grant (with maximum grants of $25,000) which totaled $591,000 (New Jersey Division of Travel and Tourism, 2019). This $9 million re-investment of the hotel tax collections represents just over 8.3 percent of the pre-pandemic 2019 collections of the NJ Hotel Tax, and this is just the state portion (the hotel tax is comprised of a 5 percent state portion, and an additional 3 percent municipal portion). Municipalities in New Jersey also directly received over $65 million in 2019 from the imposition of the municipal portion of the Hotel Tax. In total, tourism efforts in the state received less than 5.1 percent of the proceeds of the hotel tax in 2019. It is encouraging that the Governor’s proposed fiscal year 2022 budget recommends an allocation of $17.6 million for “Travel and Tourism Advertising and Promotion.” For the next step in the maturation of tourism in New Jersey, a funding mechanism that is not subject to political nuance needs to be pursued.

The monies invested in tourism in New Jersey have helped provide a support mechanism for the newly created and longer established Destination Management Organizations (DMOs) throughout the state. There are examples in New Jersey where specific legislation has allowed for the funding of larger DMOs, even ones not funded through the NJDMO grant, like the Greater Wildwoods Tourism Improvement Development Authority (GWTIDA). Since GWTIDA’s creation and receiving a dedicated funding source through the improvement district legislation, the Wildwoods have consistently grown tourism revenue at an average rate of 4 percent per year with 2019 generating the highest revenue, over $2 million. The success story of GWTIDA is an example of how proper funding can take the efforts of a DMO to a new level. Essentially, GWTIDA is a Tourism Improvement District, and an early example of one in the U.S. A 2015 Study by Destinations Marketing International found that Tourism Improvement Districts (TID’s) are now the number two source of public funding for DMOs (Destinations Marketing Associates International, 2015).

Proposed legislation would amend NJSA 40:56-65 to 89, the Special Improvement District Legislation. It seeks to allow for geographic flexibility within and across governmental instrumentalities. The legislation provides flexibility with funding assessments and sources such that Tourism and Cultural Improvement Districts (TCIDs) could decide the best solution for their areas. The established Destination Management Organizations (DMOs) in New Jersey, DMOs that are already empowering local partnerships and have the marketing expertise in general, would help lead the efforts. It is expected this proven plan with TCID’s will enhance and leverage the state’s contribution to tourism marketing. Perhaps most appealing, it establishes local control over management and funding use, empowering local jurisdictions to achieve sustainable growth.

The amendment to the Special Improvement District Legislation adds a section for establishment of a SID for the purpose of increasing tourism, referred to as a Tourism and Cultural Improvement District (TCID). It would require that the TCID be adopted by the governing body of all entities served by the TCID. A management corporation or tourism authority would be established by the legislation. Funding would be generated by the establishment of a fee or assessment of a collection authority. Which municipalities would be served by the TCID would be a function of the governing body of those municipalities.

...municipalities could band together to form such districts based on the realities of the tourism infrastructure, the culture of an area, and where the visitors are traveling to."

This is an important point, that municipalities could band together to form such districts based on the realities of the tourism infrastructure, the culture of an area, and where the visitors are traveling to. While some jurisdictions establish a countywide TCID, this model does not particularly suit New Jersey’s diverse DMO structure. Currently DMOs in New Jersey cross county boundaries and, at other times, are but a subset of a county. The Princeton-Mercer Regional Convention and Visitors Bureau, for instance, serves all of Mercer County, but also six additional municipalities, three each in Somerset and Middlesex Counties. Somerset and Middlesex Counties are in turn represented county-wide by their respective DMO’s. The three DMO’s all benefit from the cross-county promotion through partnering with each other with the goal of a successful tourism industry in the municipalities so important to DMOs of Princeton-Mercer Regional Convention and Visitors Bureau, Somerset County Tourism, and Middlesex County Tourism. As for a subset of a county, the Southern Ocean County Chamber of Commerce, a chamber that has long represented municipalities in and around the Long Beach Island region, has a well-established DMO representing the southern municipalities in Ocean County.

These are but a couple examples of the diverse geographical nature of tourism in New Jersey. Legislation establishing a TCID should be flexible and allow for multiple forms and alliances that do recognize both the current and potential tourism infrastructure as well as the flow of visitors, who are often unaware of county boundaries. TCIDs should be able to manage opposition from an individual instrumentality by creating districts to be inclusive of those wishing to participate, regardless of political or geographic boundaries. The partners in the TCID should be identified (county, municipality, authority or any combination) to allow for the most flexibility in the establishment of the TCID.

This will require support from local government. Each governmental entity must demonstrate, by municipal ordinance, its willingness to participate and its support of the funding mechanism. The ordinance should identify the composition of the management authority and the source of the funding mechanism. By including in their management established DMOs, both the composition of the management authority and additional funding will provide a firm foundation on which to build the TCID. DMO’s working with local municipalities, residents, and members of the business community will be best served to identify the proper funding mechanism for their particular area. Of course, local government support prior to adoption in the respective municipalities is crucial.

The legislation should be clear that a management corporation or tourism authority should be established “of” but not “in” the governmental entities; they should be fiscally independent. The corporation should have certain powers to manage both the management, marketing, and financial activity of the TCID and is responsible for reporting the activities of the TCID to the governmental entities in the TCID. The corporation should have representatives of all of the funding entities, as well as representatives of the governmental entities the TCID represents. It is likely, as alluded to earlier, that participating governmental entities would identify an existing DMO as the management corporation or tourism authority through specific inclusion in the establishing ordinances to be passed at the local level.

Also included in the establishing ordinance should be the identification of the funding source, or sources, to be included in the enabling ordinance adopted pursuant to the adoption of a TCID. The collection authority must be clearly stated in the enabling legislation. The authority of the collection entity must be identified in the enabling legislation. The collection entity should be identified in the adopting ordinance. Ultimately, the management corporation or tourism authority will be responsible for the receipt and distribution of the funds for the TCID, and municipal governmental agencies should have no access to or authority to use these funds.

Meanwhile, support statewide will be necessary from the New Jersey Tourism Industry Association (NJTIA), the NJTIA having long played a role in advancing the tourism infrastructure statewide. The NJTIA should seek to provide its members with draft model legislation that follows best practices seen in other TCIDs throughout the world. Similarly, drafts of model ordinances will be useful in the establishment of the TCIDs for local governments. The NJTIA should seek to provide guidance documents on TCID management infrastructures. In general, governmental affairs advice can benefit the members of the New Jersey Tourism Industry Association and strengthen any resulting TCIDs to the betterment of New Jersey’s tourism industry. The New Jersey Tourism Industry Association supports the effort to establish Tourism and Cultural Improvement Districts in the state, and will support the industry, state and local governments should the legislation pass.

References

Destinations Marketing Associates International. (2015, June). 2015 DMO ORGANIZATIONAL. Retrieved from http://www.austintexas.gov/edims/document.cfm?id=276712

New Jersey Division of Travel and Tourism. (2019, January). Cooperative Marketing Grants 2019. Retrieved from Visit NJ: https://www.visitnj.org/sites/default/files/NJ-DTT-FY19-CM-Grants-1-19.pdf

New Jersey Division of Travel and Tourism. (2020, January). Destination Marketing Organization (DMO) Grants 2020. Retrieved from VisitNJ: https://www.visitnj.org/sites/default/files/NJ-DTT-FY20-DMO-Grants-1-20.pdf

US Travel Association. (2013, June). 2012-2013 Survey of U.S. State Tourism Budgets. Retrieved from USTravel.org: https://travelanalytics.ustravel.org/Budget