SHBP Open Enrollment

Open Enrollment for SHBP is took place October 1-31, 2025. Please refer to Stockton's Open Enrollment web page or the NJ State Health Benefits 2026 Overview document for more information.

Open Enrollment is NOW CLOSED.

October is open enrollment for the State Health Benefits Program (SHBP). During open enrollment, you may change your medical or dental insurance plans, and add eligible dependents to your coverage. All changes made during the month of October will be effective on January 1, 2026. If you have any qualifying life events (e.g. births, marriage, divorce, adoption), please contact benefits@stockton.edu within 30 days of the event.

If you wish to remain in your current medical and dental plans for 2026 there is nothing you need to do.

All Open Enrollment changes must be made online through Benefitsolver before October 31, 2025 (directions below).

Information for 2026

If you are adding eligible dependents to your benefits for the first time, you will need to upload supporting documentation to Benefitsolver at the time of enrollment. For spouses, you’ll need a marriage license and the front page of your most recently filed tax return, for dependent children, their birth or adoption certificates showing your name as parent is required. A reminder to parents that had newborns in the past two years, if you only added your baby to your medical coverage and want them included on your dental insurance for 2026, please enroll them during Open Enrollment.

Employees with dependent children who are turning age 26 in 2025 do NOT need to delete

them at Open Enrollment. Their coverage will automatically end on December 31, 2025,

and you will receive additional information from this office, and the State of New

Jersey in November and December.

A recent Memorandum of Agreement (MOA) between the State and the unions representing State workers will result in some increases to our medical and prescription out-of-pocket costs (copayments and deductibles).These increases will be effective sometime in 2026 (though not January 1st). When the details are announced, there will be an additional Special Open Enrollment period early next year for health plan changes only.

Any changes to your dental plans will need to be completed during this month’s Open Enrollment.A reminder to parents that had newborns in the past two years; if you only added your baby to medical coverage and want them included on your dental insurance for 2026, be sure to enroll them during this month’s Open Enrollment.

Here is information about the three available dental plans, as well as the monthly employee cost for each.

Please visit the 2026 SHBP Virtual Benefits Fair to learn more about the benefits that are available to you. Both Aetna and Horizon will continue to offer the PPO, Tiered-Network, HMO, and High Deductible health plans in 2026.

Omnia and Liberty Tiered-Network Plan Incentive:

The State is again offering a financial incentive of $1,000 to first-time enrollees into the Horizon Omnia or Aetna Liberty health plans, provided you remain enrolled for one year. The incentive is reportable for income tax purposes. The incentive shall be forfeited and owed back to the SHBP if you fail to remain in the tiered network plans for at least one year, (for example, if you resign your employment in 2026.)

For plan comparisons, please see the 2026 Horizon and Aetna overviews. **Note that the out-of-pocket copayments and deductibles reflected in these publications will increase sometime in 2026 when the MOA changes are implemented.

If you are making any changes to your benefits at Open Enrollment, and have not yet created a Benefitsolver account, please follow these instructions.

Bart Musitano, Kim Cappuccio, and Kristen Shaughnessy, are available to you if you have any questions, would like to discuss plan changes you are considering, or need assistance with enrolling or uploading documentation into Benefitsolver. Please call, or email us at Benefits@stockton.edu. Use “Open Enrollment” in the subject line.

Online Enrollment Process

All benefit changes must be submitted through Benefitsolver, a website for State employees to enroll in their benefits, make plan changes, add new dependents, and upload required supporting documentation. You have access to Benefitsolver through the MyNewJersey portal. If you do not already have a myNewJersey account, you will need to create one in order to access Benefitsolver.

- If you are enrolled in the Public Employees’ Retirement System (PERS) or Police and Fire Retirement System (PFRS), you should already have access to the Member Benefits Online System MBOS through your MyNewJersey portal. Once you log-in, the Benefitsolver link will be included with your MBOS account as shown below. If you don’t remember your login and password, please use the “forgot your login” and/or “forgot your password” prompts.

- If you are in the Alternate Benefit Program (ABP) retirement plan, and/or DO NOT already have a MyNewJersey account, you will need to create one. You can do this by visiting the Division of Pensions website, and about a quarter of the way down the page you’ll see this button:

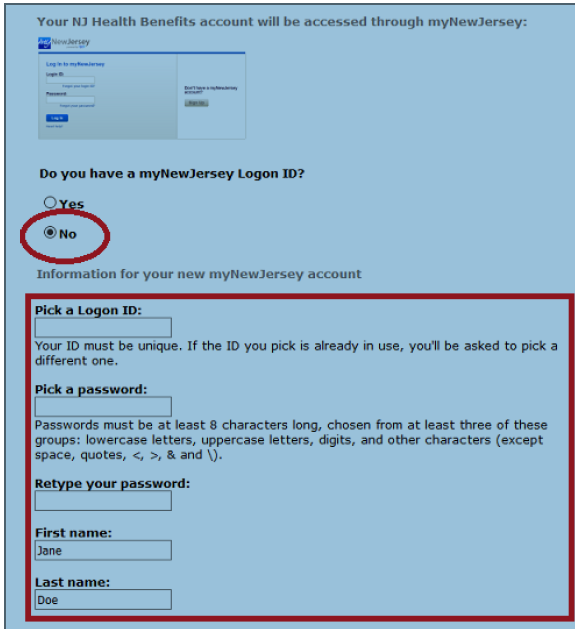

- You will “Register” with Benefitsolver, using your email, social security number, and date of birth. After clicking “Continue” you will be taken to the screen below to create your MyNewJersey account.

- Managers and supervisors who may be in the ABP retirement program, but who complete ePARs for your Classified staff members, will already have a MyNewJersey account. If so, you do not need to create a second account. Follow the directions above to “Register” with Benefitsolver, but when it asks if you have a MyNewJersey Logon ID, select “Yes” and it will prompt you to log-in to MyNewJersey. The Benefitsolver link should then be attached.

Once you have access to Benefitsolver, you can download the MyChoice mobile app for your iPhone or Android. You can use the mobile app to make changes, view your benefits, and store your ID cards. You will need online access to Benefitsolver first though in order to get the mobile access code.

For additional SHBP open enrollment plan information, you can use this link to the State Health Benefits website.

If you have any questions, please feel free to contact benefits@stockton.edu.

Tax$ave allows full-time employees to set aside pre-tax dollars to pay for certain medical, dental, and dependent care expenses through Flexible Spending Accounts (FSAs).

Enrollment in the FSA does NOT carry over from the previous year. Even if you are contributing in 2025, if you wish to participate in 2026 you must complete a new enrollment during the month of October.

If you do not want to enroll in the FSAs, there is nothing that you need to do.

For 2026, Horizon Blue Cross Blue Shield of New Jersey continues as the administrator for the FSAs through Horizon MyWay.

There are two voluntary FSA accounts. You may select one, or both.

- Medical FSA- Use this account to pay for co-payments and other qualified medical, dental, and

vision care expenses that you andyour eligible dependents incur, which are not paid by your health, prescription, and dental insurance. Many

of these expenses can be paid using your FSA-issued debit card.

- Employees will see increased out-of-pocket medical and prescription expenses sometime in early 2026. Consider accounting for these when deciding your FSA election amount for 2026.

- (If you are currently participating, you will not receive new FSA debit cards unless your current card has an expiration date. If you newly enroll in the medical FSA at Open Enrollment, your debit cards will be mailed in November or December of 2025)

- Dependent Care FSA- Use this account to cover eligible child day care or elder day care expenses.

Please review this Essential Reference Guide to learn more about the benefits of the Horizon MyWay FSA to see if one or both of these accounts are right for you.

How To Enroll:

- Online Enrollment (preferred)

o Login using your SS# and date of birth, and then provide an email address.

o You will make separate elections for the Unreimbursed Medical FSA and the Dependent Care FSA. (Be careful that you’re choosing correctly)

o Print out your confirmation, and you’ll also receive an email confirmation of your election(s). Save the confirmation.

- Complete a paper enrollment and fax it directly to Horizon MyWay at 866-231-0214 or send via email to HorizonMyWay.Documents@HelloFurther.com. If you are choosing the fax option, save the receipt as proof that the fax was sent successfully.

Enrollments must be submitted directly to Horizon by October 31, 2025.

Horizon MyWay will be hosting three informational webinars during the month of October. Below are the links if you’d like to register to learn more about the FSAs.

|

Wednesday, 10/8 at 12pm ET |

|

|

Thursday, 10/16 at 1pm ET |

|

|

Thursday, 10/23 at 12:30pm ET |

If you have any questions, please email Benefits@stockton.edu, and use the subject line “Open Enrollment.”

Need Assistance?

- View the full list of HR staff including notes on who can help you with what

- Or, call us at 609-652-4384

- Or stop by our suite in J-115

We look forward to getting you what you need, answering your questions, and/or connecting you with the HR team member that can best help you.