Admissions

At Stockton University, you can choose an experience that matches your interests.

With more than 160 areas of study, convenient location, small class sizes and affordable tuition, the choices are endless.

Learn why our students chose Stockton.

Stockton has allowed me to connect with passionate and experienced nursing faculty.

Class of 2027

I 100% recommend attending a campus tour. It is the reason I fell in love with the university.

Class of 2026

Stockton is known for having one of the best Education programs in New Jersey.

Class of 2025

Stockton helped me prove that higher education is possible at any stage in life

Class of ’25, MSW ’26

Stockton's given me the opportunity to explore my interests and follow where they take me.

Class of 2026

Being able to do hands-on work allows me to see sustainable agriculture in action.

Class of 2026

From the first time I visited, I felt welcomed and supported.

Class of 2026

Stockton’s mentorship opportunities have transformed me into the leader I am today.

Class of 2026

Stockton offered a great environment for me to grow academically and personally.”

Class of 2025

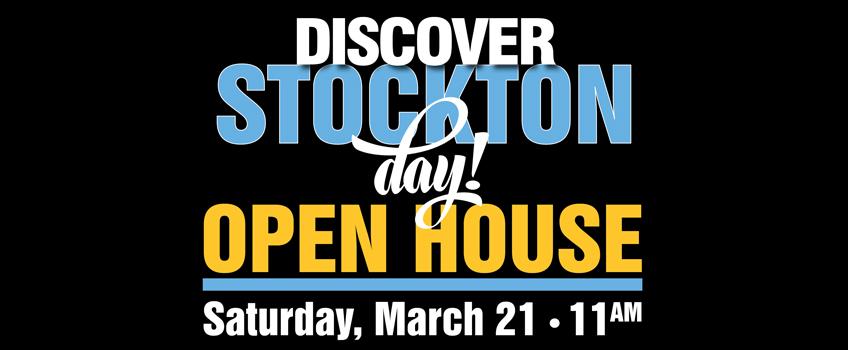

Visit Us In-Person

- Personal & Group Tours

- Self Guided Tours

- Open House Dates

Experience our Virtual Tours

Beachfront Living & Learning

- Steps to the Boardwalk

- Shuttle Service to and from Galloway campus

- Fitness center

- Hundreds of courses offered

Financial Aid & Scholarship

Stockton's Scholarship Program provides awards to outstanding first-year students, upperclassmen and graduate students.

Career Education & Development Services

A Stockton education opens the door of opportunity for your future.

Continuing Studies

Stockton is dedicated to enriching the lives of lifelong learners with professional development and workforce training.